Here we are, three-quarters of the way through a tumultuous 2020.

And I can safely say that no one would have guessed how the market has evolved in this short time.

While COVID-19 and the presidential election dominate the news cycle right now, there has been another major story breaking for much of the year.

Private companies now have more options to go public than ever before. Leading this change is the method of reverse merging with a special acquisition company or SPAC.

I’ve written about these many times, simply because many of the largest and most exciting deals of 2020 come from this IPO method.

SPACs are often called blank-check companies because they are, well, blank checks.

They IPO themselves but have no operations. These are essentially shell companies that hunt for exciting private unicorns to take public.

They aren’t anything new. They have been around for more than a decade.

But this was their breakout year, as the virus put a halt to many companies seeking traditional IPOs.

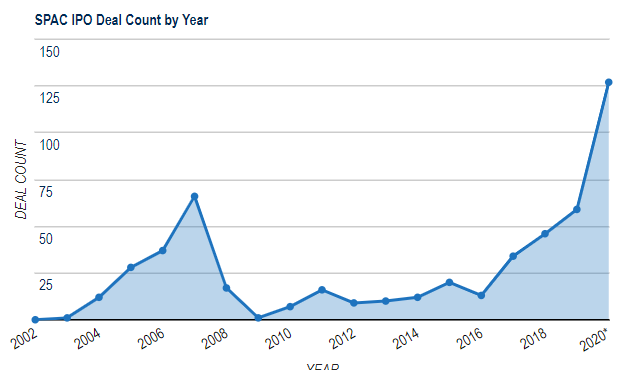

In fact, the number of SPACs coming to market have simply exploded:

Already in 2020, we’ve seen more than twice the number of SPAC IPOs and three times the gross proceeds compared to last year.

Some $47.5 billion has been raised through these blank checks to go out and find winners.

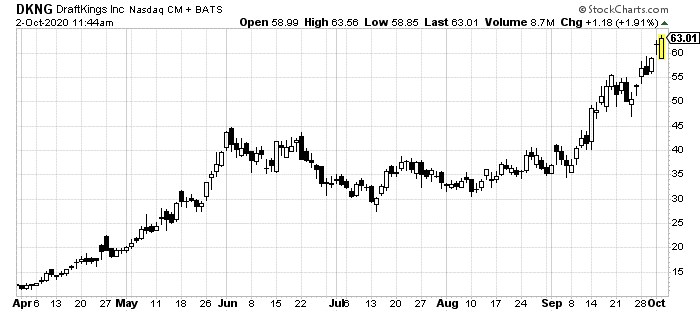

And there have been some big ones too. DraftKings Inc. (NASDAQ: DKNG) notably went public this year to much fanfare.

Since its merger with a SPAC back in April, its stock has quadrupled in value.

So, it should be no surprise that the ETF market wants in on this action.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Yesterday, the Defiance Next Gen SPAC Derived ETF (NYSE: SPAK) debuted. This is the first major exchange-traded fund to venture into this booming market.

But there are a few things you ought to know about what it actually does.

First, this ETF is theoretically a diversified fund that passively invests in the overall SPAC market. Meaning it does hold SPACs that are still seeking partners.

But it also holds post-merger stocks that have already changed names and completed deals.

In fact, 80% of SPAK’s holdings are in completed deal companies. Twenty percent of its assets are in DraftKings’ stock alone.

I’m not saying this is a bad thing. But it does change the performance of the ETF itself.

With 80% of its holdings outside of the SPAC market itself, it doesn’t really take advantage of the announcement or merger events themselves.

In other words, SPAK is basically a fund that represents the performance of companies that went through the SPAC process… not the companies currently going through it.

There are a number of reasons why this fund breaks down its holdings in such a way.

Since SPACs usually don’t see much volume before they announce a merger deal, it’s harder for a major ETF to pick up shares.

Likewise, since the total values of many SPACs fall under the ETF’s $250 million market cap threshold, the number of available SPACs to choose from goes down significantly.

Prior to 2020, the average SPAC IPO size was only $230 million. So, more than half of the market would previously not qualify for this ETF.

That has dramatically risen this year. But that’s mostly because of a few large SPAC IPOs like Bill Ackman’s Pershing Square Tontine Holdings IPO in July worth $4 billion skewing the average.

So, if you have been following the boom in SPACs and the monster deals and successes like DraftKings, you might want in on this market. Just be aware that SPAK isn't necessarily what it seems.

However, if you believe companies who have recently completed a merger with a SPAC are set to rise, this new ETF is exactly what you are looking for.

I like to look at individual emerging profit opportunities. And the best way to do that is to pick out specific deals, though a pre-merger SPAC or otherwise.

As with everything in the investment world, a little research goes a long way.

In fact, I’m wrapping up the next issue of Wealthy Technology Investor. In it, I’ll be featuring a company very-much relevant to this topic.

Click here to get started today so you don't miss this newest hot pick.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder